After the Reserve Bank of Australia hiked the cash rate by 25 basis points to 0.35%, there was one question on every property investor’s lips: will rising interest rates cause property prices to fall?

After all, record-low mortgage rates were a driver of the recent property boom. So it stands to reason that rising rates would affect buyers’ borrowing power and therefore buyer activity – especially as more rate rises are likely in the coming months.

As such, the RBA estimates that a two-percentage-point increase in mortgage rates will reduce real housing prices by 15% over a two-year period. The major banks agree – and you only have to look at CoreLogic’s April home value index to see buyers are starting to get spooked by the thought of rate rises.

But here’s a radical thought.

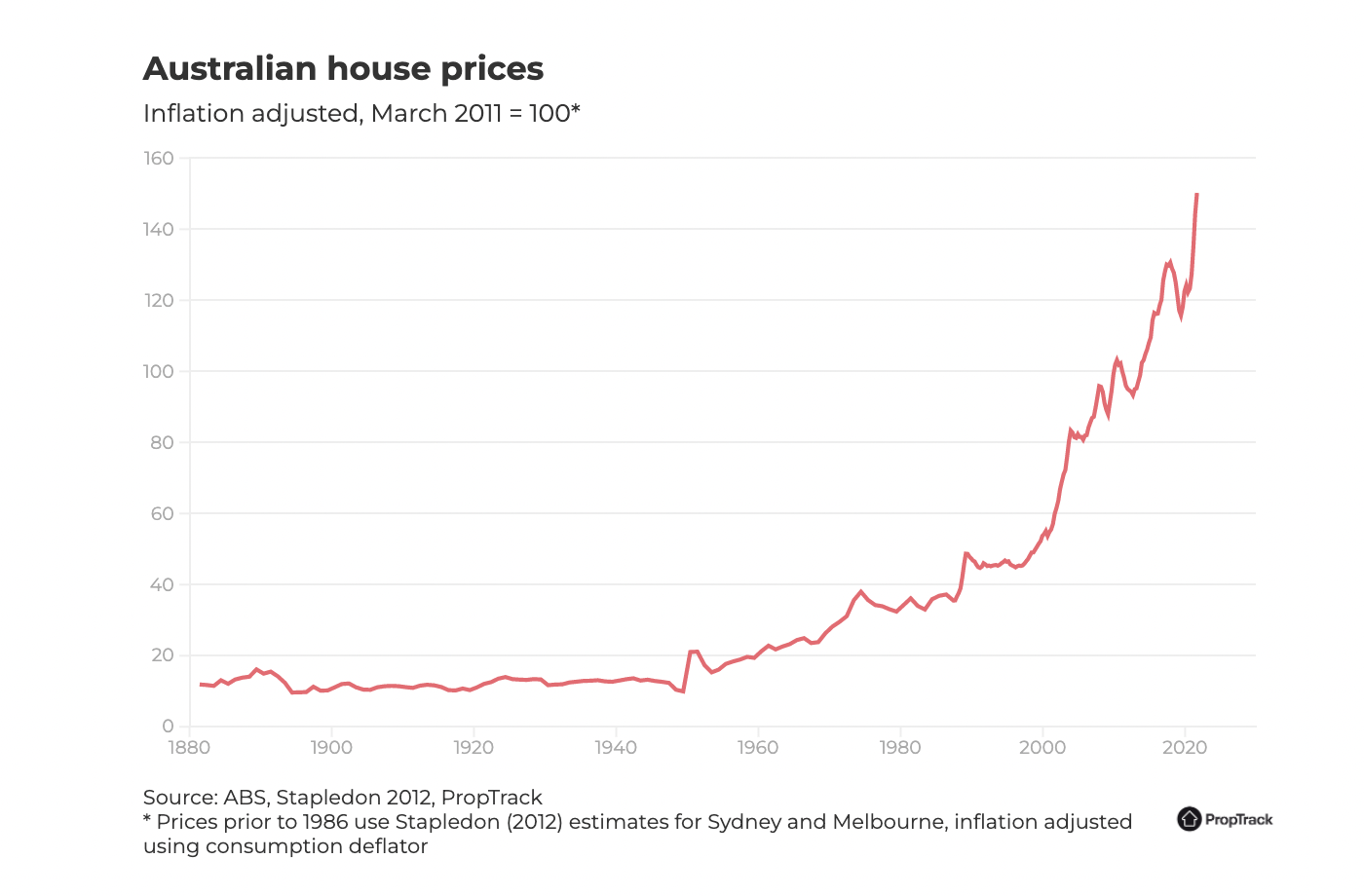

As a property investor, it shouldn’t matter what property prices do in the short term. And the PropTrack graph below clearly illustrates why.

After accounting for general price inflation, you’ll see the long-term historical trend for house price growth is upwards

Naturally, there have been a few dips along the way, such as a sharp recession in the early 1980s, the 2008 Global Financial Crisis and the 2017 downturn (caused by tighter lending standards). There have also been countless interest rate movements throughout the period.

Yet property prices have kept rising. In April 1993, the median house price across Australia was $111,524. By March 2022, that figure had reached $1,069,289, rising by a staggering 859% over 29 years.

Of course, past performance is no guarantee of future results. But history suggests that if you buy quality properties in quality locations and hold them for the long-term – rather than worrying about short-term interest rate decisions and property price fluctuations – you’ll enjoy a strong financial return.