There’s plenty of negative news these days, what with prices rising, interest rates rising and property prices falling.

But it’s important to put these so-called problems into perspective.

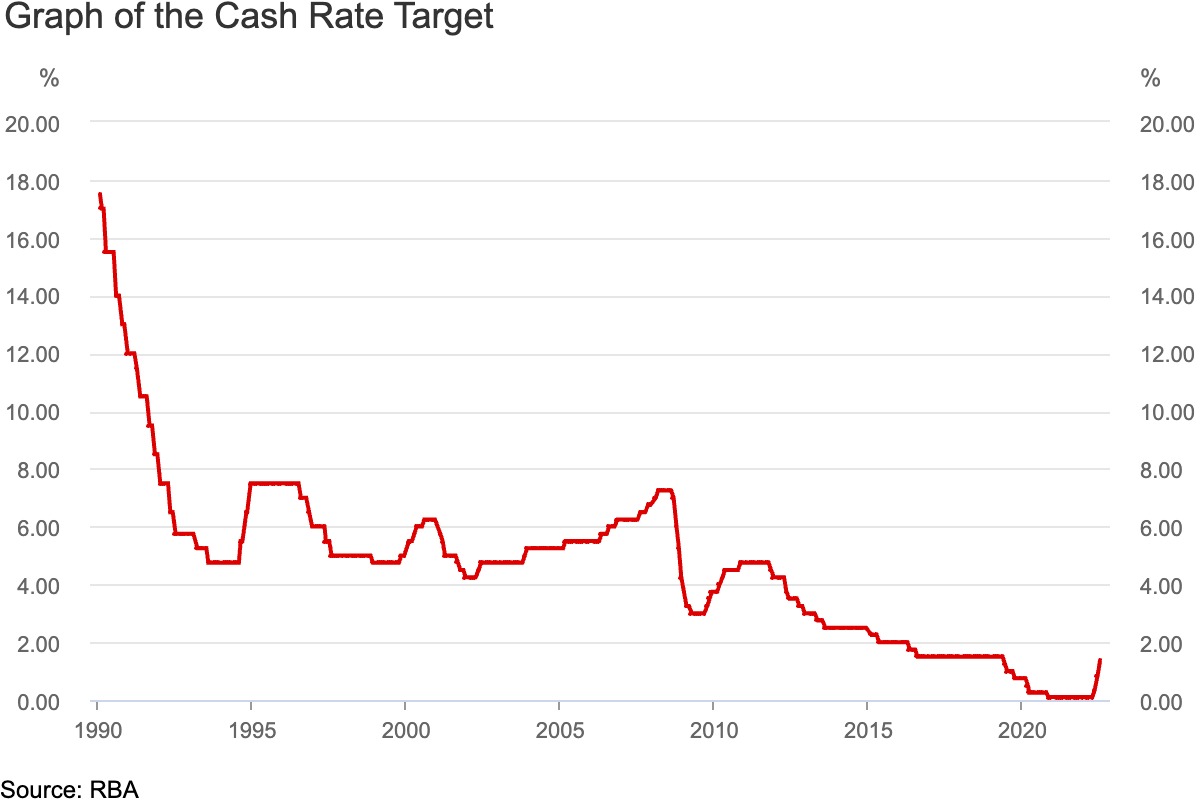

Take interest rates, as an example. While the Reserve Bank of Australia recently hiked official interest rates for the third time in as many months, the cash rate was starting from a historically low base – as the graph below clearly shows.

So, regardless of where we end up at the end of this tightening cycle, it’s still likely to be low by historical standards.

Then there are property prices.

Australia’s property markets have just experienced an extraordinary boom, so there was bound to be a correction as we transition into the next phase of the property market cycle. While that might cause price growth to slow down or go backwards in some locations, history tells us that the long-term trend will almost certainly be up.

However, to qualify, you can’t own any other properties. Also, you’ll have to live in the property initially – although, in the future, you could buy out the government’s stake and convert the home into an investment property.

Australia’s triple-A economy

What about talk of a weakening economy?

Well, while there are economic challenges ahead, Australia is in much better shape than the media likes to present. Moody’s recently affirmed our AAA status, making Australia one of only nine countries in the world to have a AAA credit rating with the three major ratings agencies.

Moody’s expects Australia’s economy to remain resilient even as the global economy slows. This isn’t surprising when you consider our:

- Historically low unemployment numbers – which, at 3.9%, is one of the lowest in the world for a major developed economy (see below)

- Robust GDP growth – with the economy growing at 3.7% in the year to March

- Record-high trade surplus – driven by surging coal prices

A word about jobless numbers

Some people have wondered if the government is manipulating jobless data to make it look like Australia’s economy is doing better than it really is.

The Australian Bureau of Statistics measures the unemployment rate by conducting a labour force survey each month. This is so the ABS can find out how many people there are who want to work but don’t have jobs.

As a result, to be classified as ‘unemployed’, a person must meet:

- Not work more than one hour in the reference week

- Be actively looking for work

- Be available to start work in the reference week

So if you work one hour a week, you will be classified as employed. However, on its website, the ABS says there are several reasons why it includes everyone who works at least one hour a week as employed:

“From an economic perspective, any time in paid work, no matter how small, contributes to economic production and is therefore included in the national accounts. Labour force statistics are economic indicators and need to be coherent with other economic measures.”

This isn’t a new thing either, with the unemployment rate being measured in this way since 1966. Other countries such as the UK also use the same criteria when measuring their jobless rate (as does the International Labour Organisation).

To help people better understand the extent of the underutilised labour supply in the country, the ABS also measures something known as the ‘underemployment’ rate.

This measures people who are employed, but would like and are available to work more hours – which they aren’t getting. In May, Australia’s underemployment rate was 5.7%.