The Reserve Bank of Australia has increased the nation’s official interest rate 12 times in just over a year, taking it from a historically low 0.10% to an 11-year high of 4.10% in June.

Higher interest rates are no longer weighing down on the property market, with CoreLogic’s home value index posting a 1.2% gain in dwelling prices in May – its third consecutive monthly rise.

However, they are making some mortgages more expensive.

Generally speaking, each 25-basis-point increase adds about $15 for each $100,000 borrowed onto variable-rate home loan repayments.

The rate you get charged on your investment loan can play a significant role in your investment’s profitability. So it’s important to make sure you’re on a competitive deal.

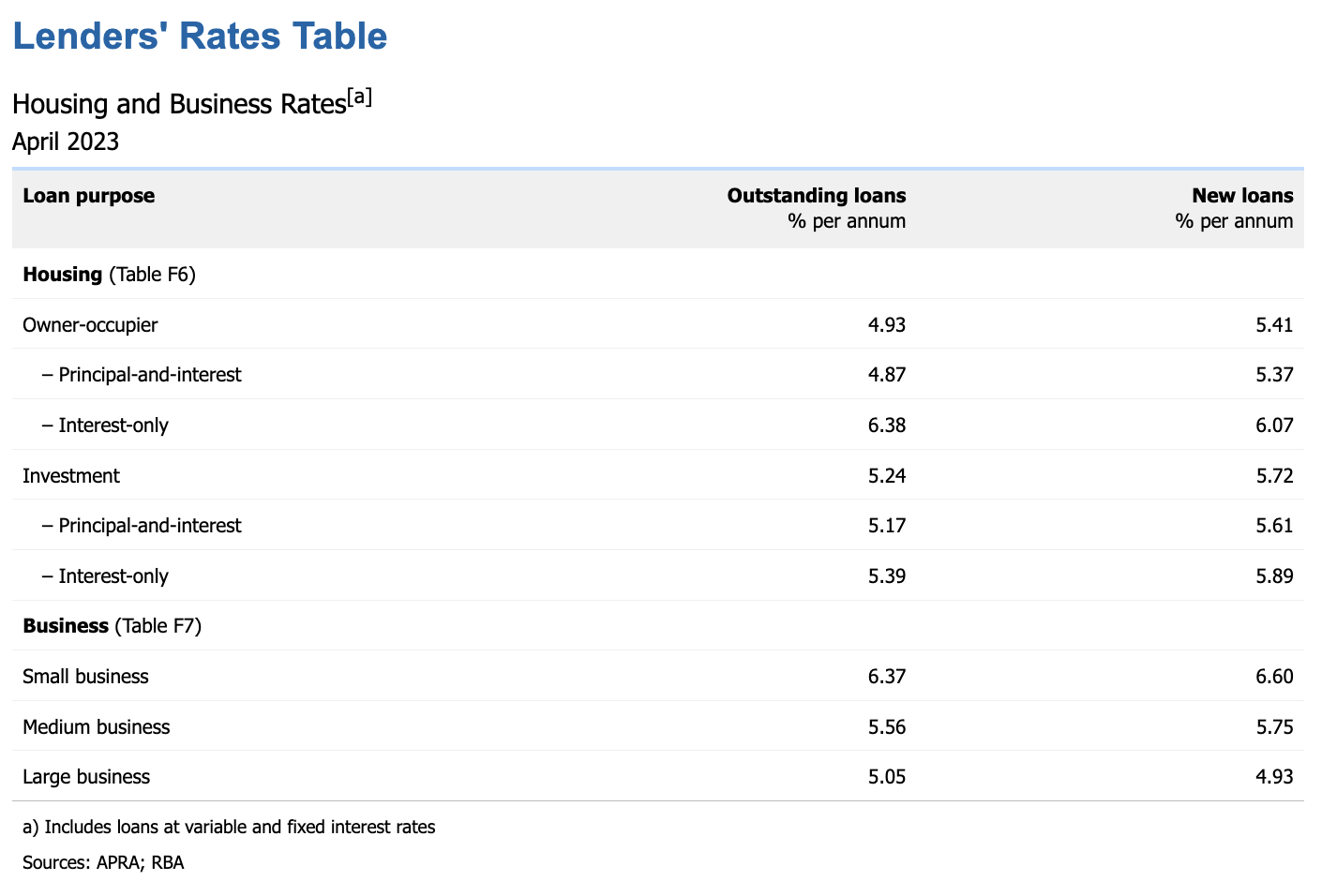

But many lenders charge their existing customers higher rates than those offered to new borrowers, as the RBA table below shows.

So if you’ve had your investment loan for a while, it might be time to contact your lender and renegotiate your deal.

Here’s how.

1. Do your homework

Before calling your lender, arm yourself with knowledge. Find out what deals your existing lender is offering new customers (making sure the rates are for comparable products). Additionally, compare your lender’s rates with their competitors.

2. Make your case

Lenders are more likely to offer competitive rates to borrowers who demonstrate low risk. So if your credit score is good and you’ve never missed a repayment, use these factors to your advantage during the negotiations.

3. Be prepared to walk away

Negotiating a lower home loan rate is a two-way street, with no guarantee your lender will play ball.

If your lender is unwilling to budge on the terms, call their bluff and ask for a mortgage discharge form. This could be all the motivation they need to offer you a better deal.

Failing that, consider taking your business elsewhere.

4. Consider working with a mortgage broker

A mortgage broker can negotiate on your behalf, using their relationships and expertise to potentially secure you a competitive rate.