One of Australia’s leading property research groups has forecast that prices will rise in most capital city markets during the 2023-24 financial year.

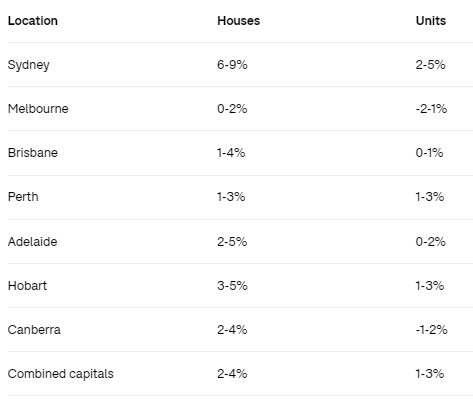

Domain’s forecast, which covers the period between the start of June 2023 and the end of June 2024, is for the combined capitals to experience median price increases of 2-4% for houses and 1-3% for units.

Of course, different markets move in different cycles, so the outlooks differ from city to city:

The idea of property prices growing might seem odd to some, given the sharp rise in interest rates over the past year.

However, history shows that while interest rates do affect property prices, they’re just one of multiple factors.

Demand is surging but supply is sluggish

Domain’s chief of research and economics, Nicola Powell, said the reason property prices are set to rise during this financial year is because supply is unlikely to keep up with demand.

“Australia has seen an exponential increase in temporary and permanent migration since the international border reopened in late 2021 to alleviate skills shortages. Of course, unlike natural population growth, those arriving from overseas aren’t already housed. This puts us in a position where in the next financial year alone, nearly 130,000 extra dwellings will be needed, with the eastern seaboard receiving the largest share of migrants,” she said.

“When you combine this with unprecedented headwinds in the construction industry and unseasonably weak listings, this has contributed to a forecast of continued tight housing supply that drives up market competition. While prices are expected to rise, affordability will contain the pace of growth, as the likes of rapidly rising interest rates and ongoing mortgage serviceability challenges continue to play out in a complex and dynamic market.”

While this short-term forecast is interesting, what really matters is the long-term outlook.

History suggests that if you buy a quality property in a quality location, you’ll enjoy strong capital growth over the long-term, despite the inevitable downturns that occur from time to time. So if your financial circumstances allow and you’re prepared to play the long game, now could be a very good time to enter the market.