Despite the typical doom and gloom in the media, the property market is in good shape right now for property investors, with prices rising, rents rising and interest rates seemingly at or near their peak.

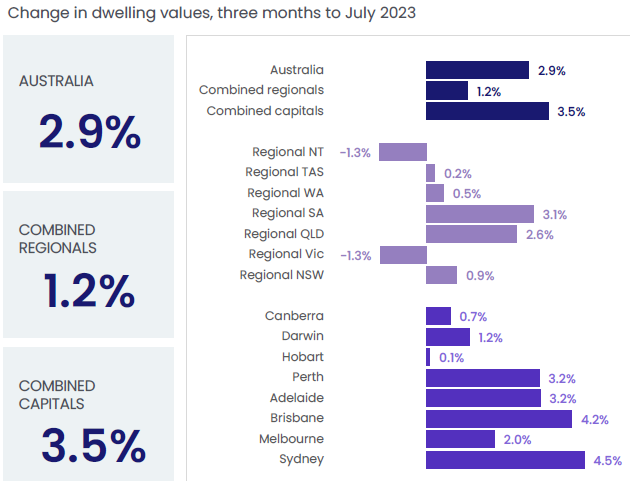

In terms of the sales market, the national median price rose 2.9% in the three months to July. That included an increase of 1.2% in the combined regions and price rises in every capital city.

Moving on to the rental market, vacancy rates are staggeringly low in most parts of the country, including just 0.4% in Perth and Adelaide, according to Domain (see table below).

That means it’s easy for investors to find tenants. It also means there’s strong upward pressure on rents, which explains why Australia’s median rent rose 9.4% in the year to July, according to CoreLogic.

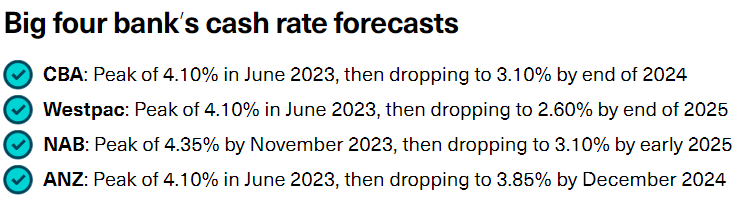

The other key indicator right now is the cash rate, which increased from 0.10% in May 2022 to 4.10% in June 2023.

The Reserve Bank left the cash rate on hold at its July and August meetings – and three of the big four banks believe rates have now peaked, according to this RateCity analysis. Moreover, all of them believe rates will start falling next year.

How to navigate the 2023 market

The first tip for making the most of the current conditions is to block out the media noise. To be a good investor, you need to stick to the facts and focus on the long-term – but the media tend to sensationalise issues and focus on the short-term. So ignore the headlines. Instead, ask yourself this: if I buy a quality property in a quality location in 2023 and hold it for the long-term, will that help me grow my wealth?

Second, don’t limit yourself to investing locally, because Australia is a big country and there may very well be better investment locations interstate. Right now, Investors Dream is helping clients buy properties in select locations in multiple states, all of which are showing strong fundamentals.

Third, find a good mortgage broker. (If you don’t have a broker, Investors Dream would be happy to introduce you to one.) With a broker’s help, you should be able to borrow more than if you approached a bank on your own, because your borrowing power can vary significantly from lender to lender. The more finance you’re able to deploy, the more options you have in the property investment market.