Australia is grappling with a significant housing supply crisis which is bad news for both renters and potential homeowners.

To solve the problem, the federal government has set an ambitious target of facilitating the building of 1.2 million new homes over the five years from July 2024. But is this goal realistic?

A tough challenge

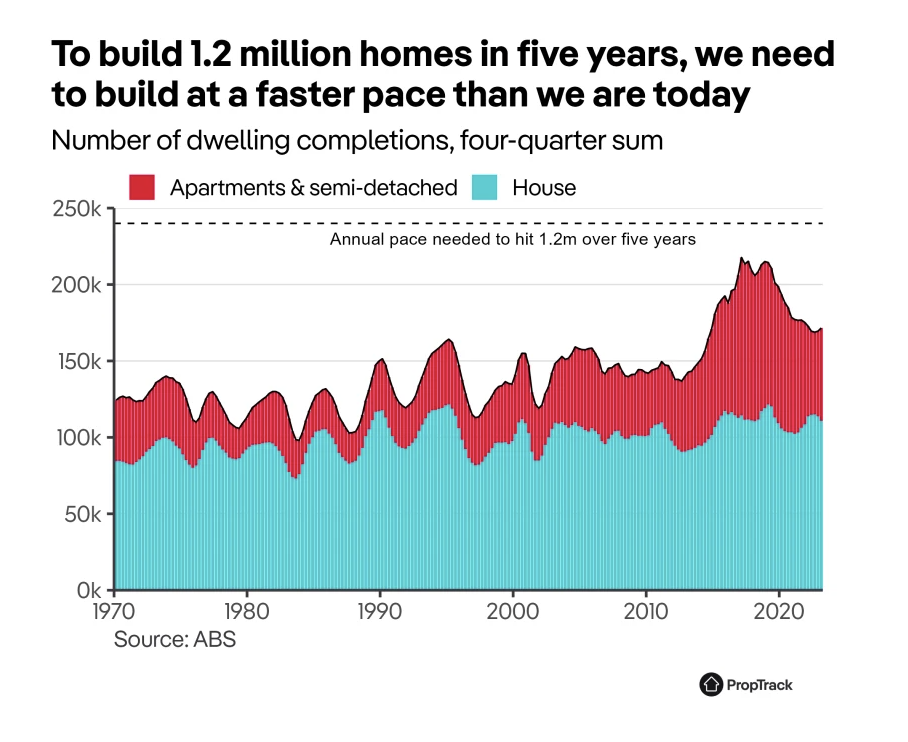

To meet the target, Australia needs to build 240,000 homes every year. However, we’re currently falling short, completing only about 170,000 new homes in the year to March 2023, well below what’s needed (see PropTrack graph below).

This means the construction pace needs to ramp up by almost 40% to hit the target.

However, that’s a tough ask as several challenges make it difficult to accelerate building activity in Australia.

Construction roadblocks

The construction sector was severely disrupted by the pandemic, with supply chain issues affecting the availability of raw materials. These disruptions have significantly lengthened the time required to build a home and escalated costs.

For instance, CoreLogic’s Cordell Construction cost index found national residential construction costs soared 11.0% over the year to September 2022, the highest annual rate on record.

Although costs have started to stabilise since then, we’re still dealing with the fallout, slowing down the construction pipeline considerably.

Building approvals have also dwindled as interest rates have risen.

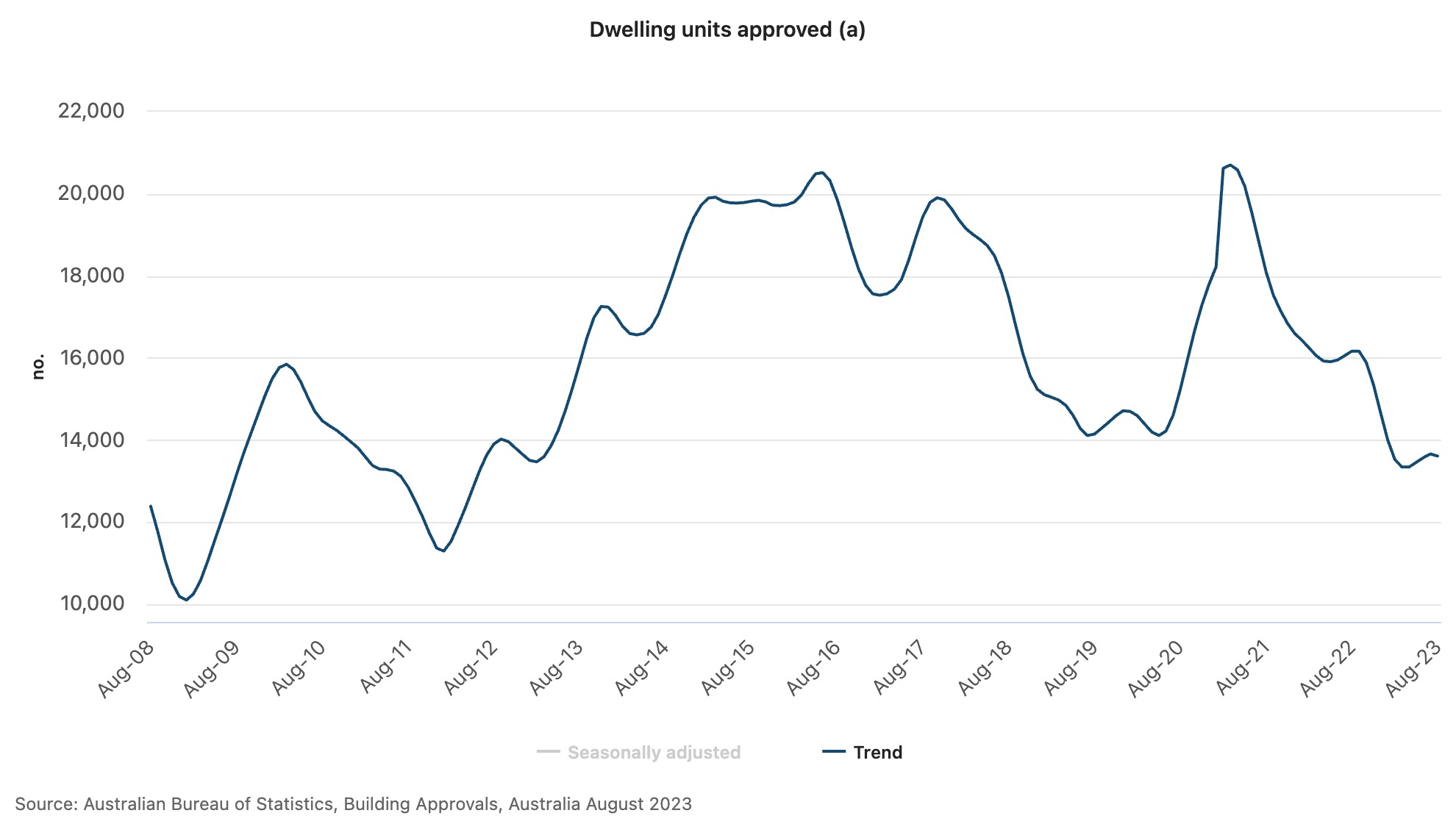

Recent Australian Bureau of Statistics (ABS) data shows a marked decrease in building approval rates following the Reserve Bank of Australia’s first interest rate hike in May 2022 (see image below).

More concerning, there’s been a shift in the type of homes receiving building approvals.

While approvals for detached houses have slightly slowed, the most significant drop has been in high-density housing, like apartments and semi-detached homes.

For instance, in August, ABS data showed a 34.1% year-on-year fall in building approvals for ‘private sector dwellings excluding houses’ compared to a 15.2% drop for ‘private sector houses’.

To hit its 1.2 million home target, Australia needs to approve and build many more high-density homes than are currently in the pipeline.

What does this mean for rents and prices?

Rental availability is already at an all-time low in Australia, with Domain’s most recent rental report showing a nationwide vacancy rate of just 0.8% during the September quarter.

Ultra-tight rental markets are pushing rents higher, with house rents at a record high across the combined capitals and all cities except Canberra and Hobart.

Likewise, low supply amid strong demand has already driven Australian property prices up for eight consecutive months in September, despite the downward pressure of high interest rates.

Failure to meet the housing target will likely continue to tip the balance of market power in favour of landlords and sellers.