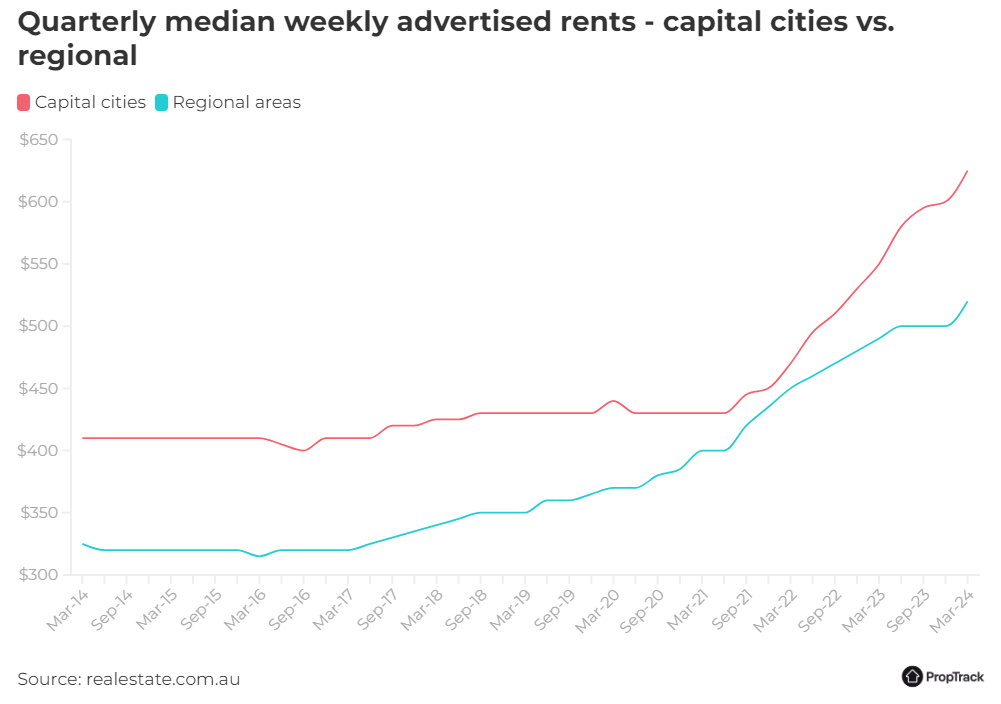

PropTrack’s March 2024 report indicated an annual increase of 9.1% in advertised rent. This was the first time in two years that this statistic was below 10.0%.

But while there are signs of a slight slowdown, Australia’s rental market is unlikely to experience a significant cooling period in the near future.

Moreover, rents are still climbing rapidly, particularly in capital cities.

Upward pressure on rental rates

Australia’s vacancy rate in March 2024 was 1.1%, down from 1.3% the same month last year, according to PropTrack. Several factors are contributing to the sustained tightness of the rental market which, in turn, are putting upward pressure on rents.

Firstly, the country’s population continues to grow with the Australian Bureau of Statistics (ABS) recording a 2.5% annual increase in September 2023. This is forecasted to continue, with the Centre for Population projecting 1.2% annual growth until 2034.

This growing population means more people who require a place to live. This puts demand on the already constrained housing sector.

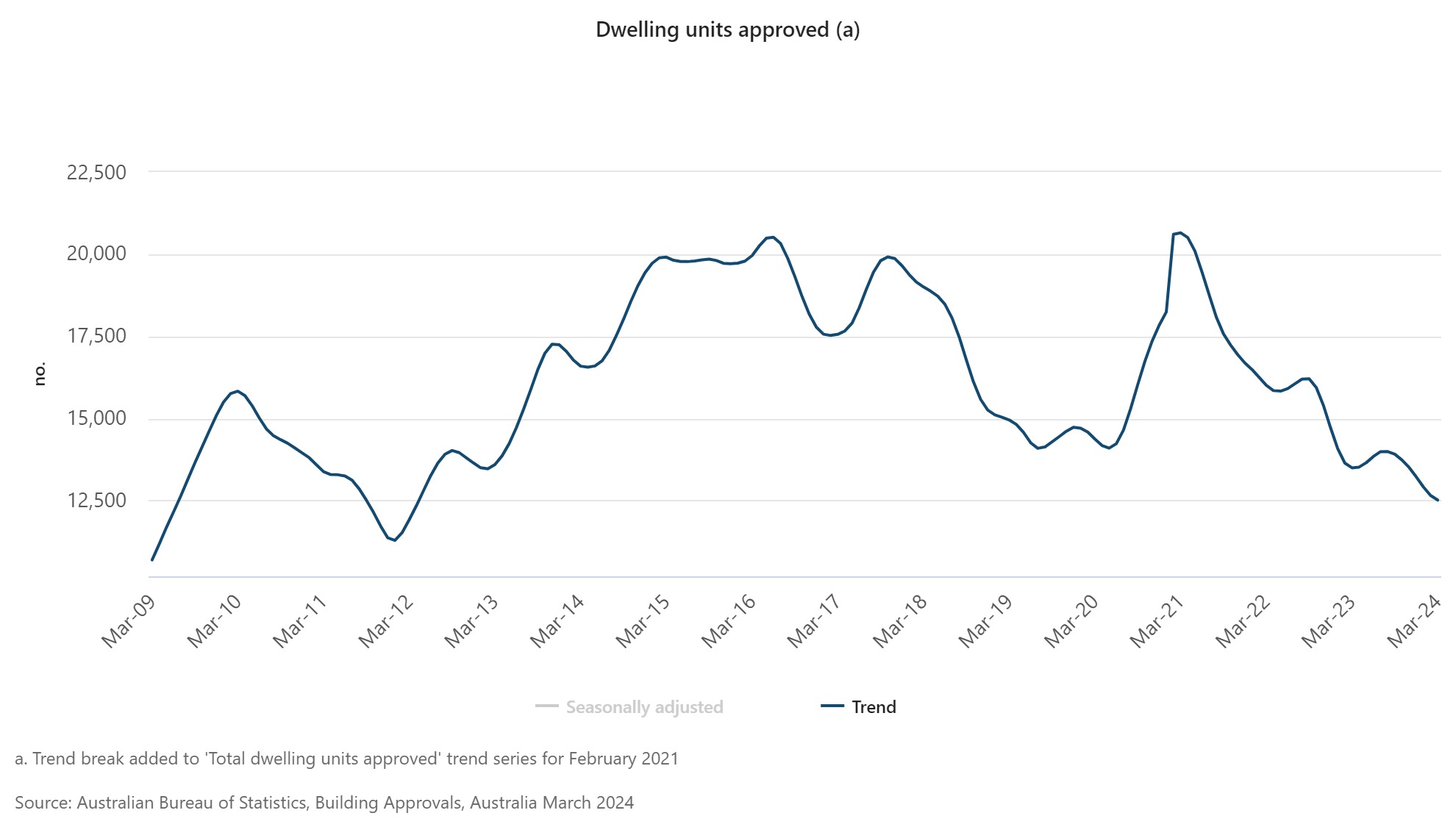

Secondly, building approvals remain low, so there’s a shortage of new homes entering the market to meet this growing demand. The ABS reported an annual decline in total approvals of 7.3% in March.

A new report from the National Housing Supply and Affordability Council showed that at the current rate of approvals, the new supply of homes will remain below average into 2024.

In the long-term, the council predicts the federal government’s plans to facilitate the building of 1.2 million new homes in the five years starting 1 July 2024 will fall short.

That’s after the report estimates the country’s growing and existing population will add 1.08 million new households over the five years, but only 1.04 million new homes will be built.

Rising interest rates and climbing property prices, up 8.7% annually in April according to CoreLogic, have pushed homeownership further out of reach for many Australians. This has kept these potential buyers in the rental market, intensifying competition for available rental properties. Property prices are projected to continue rising as long as supply remains low.

Differences in location

But, there are some variations in the trends.

While capital cities grapple with high rents, regional areas often offer more affordable options. Advertised rents in regional Australia grew 6.1% in March, as opposed to the 13.6% surge in capital cities, according to PropTrack.

As the graph shows, rents in regional locations remain lower than in the capital cities.

This offers some choice to renters who may opt to live in regional locations, easing pressure somewhat in the most competitive markets.

Market slowing, but not yet cool

Overall, while the pace of increase may be moderating slightly, the country’s rental market is unlikely to see a dramatic cool-down any time soon.

The combined factors of population growth, very limited new supply and affordability constraints for potential buyers will continue to keep rental demand high. This, in turn, puts upward pressure on asking rental rates, making investing in property an attractive option.