Where will property prices head in 2025?

National property prices are forecast to rise in 2025, although the pace of growth will be slower than this year’s.

According to experts, next year will be one of two halves, with 2024’s property price slowdown not only carrying over into 2025, but declining further over the first six months of the year. However, once interest rates start coming down – which is expected from mid-year – price growth will pick up.

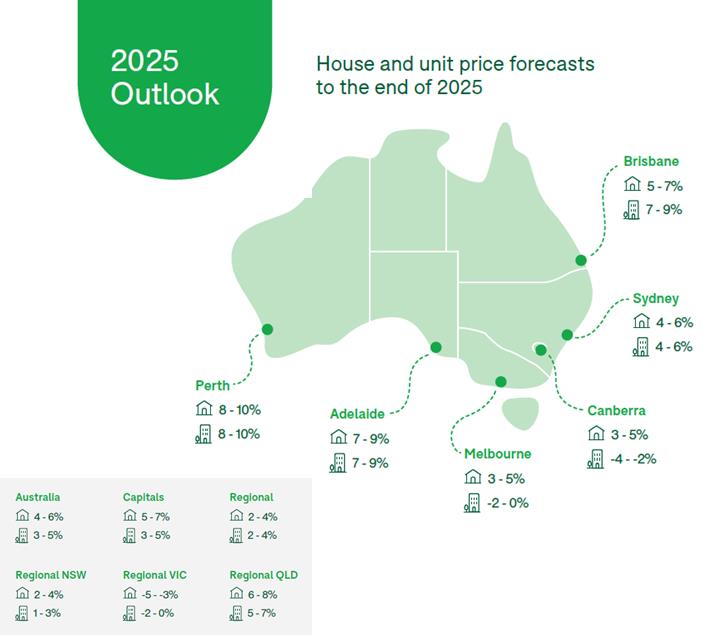

Of course, there are great deviances between locations, with some capital cities forecast to record falling prices by the end of the year and others double-digit increases.

National outlook

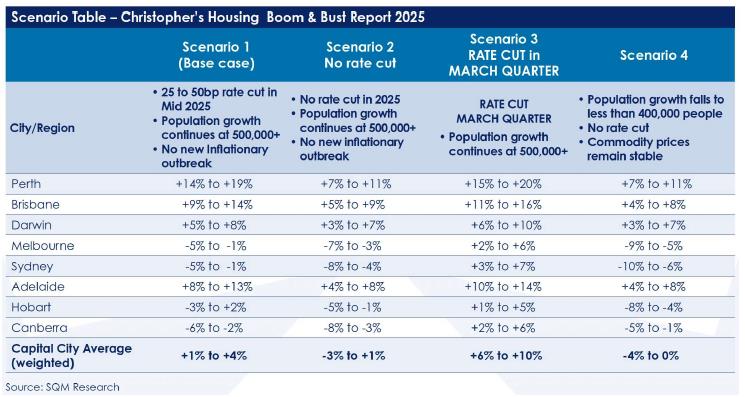

SQM Research expects cash rate cuts of between 0.25 percentage points and 0.50 percentage points over the next 12 months; should this scenario play out, national dwelling prices will increase between 1% and 4%.

“If interest rates are cut as forecasted, this event will immediately stimulate homebuyer demand across the country,” SQM said.

Should rates, population growth and inflationary factors head in other directions though (as seen in the image below), prices could drop as much as 4% and rise up to 10%.

Domain chief of research and economics Nicola Powell said weaker housing market conditions were expected over the first half of 2025.

“But I think we have to remember that once we start to see rates being cut, that’s what’s going to create this year of two halves, with stronger conditions in the second half.”

Echoing this, CoreLogic research director Tim Lawless said there was unlikely to be a turnaround in weakening price growth until interest rates came down. And with three of the big four banks now expecting the first cash rate cut in May, any improvement will probably only be seen in the latter part of 2025.

“A couple of rate cuts might be enough to shore up a declining trend in home values, but it is hard to see any material upward pressure returning until interest rates reduce more substantially and affordability barriers are less formidable,” he said.

Capital city outlook

Housing markets in Perth, Brisbane, Adelaide and Darwin are, however, predicted to outperform the national market, according to SQM Research. Perth is expected to record the fastest price rises at 14% to 19%, while Brisbane and Adelaide could see prices go up as much as 14% and 13% respectively.

Meanwhile, Sydney and Melbourne property prices are expected to continue seeing moderate falls of 1% to 5%. Canberra is predicted to record the largest price falls of 2% to 6%.

By the end of 2025, Powell said the median capital city house price is forecast to be 5% to 7% higher at $1.213 million. In fact, most of Australia’s capital cities will have a median house price above $1 million by the end of next year.

Domain expects national median house prices to go up 4% to 6% and unit values to rise between 3% and 5%, with these figures are predicted to be higher across the combined capitals than the combined regions.