Regional property investment outlook for 2025

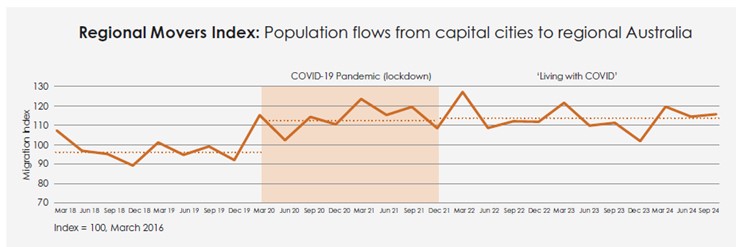

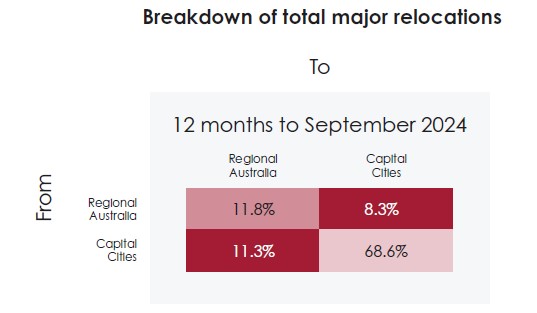

More Australians are ditching the city grind for a regional lifestyle – and property investors are taking notice. Population flows to regional areas are at a two-year high, up 80% on pre-Covid levels, according to the latest Regional Movers Index (RMI).

With more people choosing to live outside major cities, regional markets are seeing rising demand from both home buyers and investors. And as the latest data suggests, investors are becoming more willing to look further afield to find the right opportunities.

The latest PIPA (Property Investment Professionals of Australia) Advisor shows that, in 2024, investors were seeking properties, on average, 1,800 kilometres further away from their residences than in 2017.

The five main drivers of regional property investment are:

- The rise of remote work and changing lifestyles

- Affordability and greater value for money

- Infrastructure development and regional growth

- Expanding investment horizons

- The desire to diversify risk further afield

Why regional migration is surging

The latest RMI for the September 2024 quarter shows that the number of people moving from capital cities to regions was 35.6% higher than the number leaving regional areas for the cities.

During the pandemic, the work-from-home revolution triggered a rush toward sea- and tree-change lifestyles. But when lockdowns ended, many chose to stay in their new hometowns.

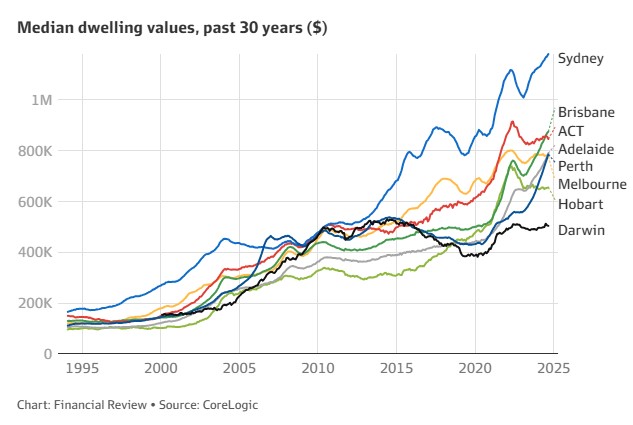

For some, rural life proved to be the perfect fit. For others – especially those required to return to office-based work – the rising cost of living and soaring city property prices made moving back financially unfeasible. Since the pandemic, home values in Adelaide, Perth, and Brisbane have surged by as much as 77%, according to CoreLogic data.

According to the RMI, the decline in migration flows from regional areas to the cities may not only indicate the impact of rising living costs but also the tightening of urban housing and job markets. At the same time, regional job vacancies have increased and more affordable housing in these locations has made it easier for first home buyers to step into the market.

Regional property demand – and price growth

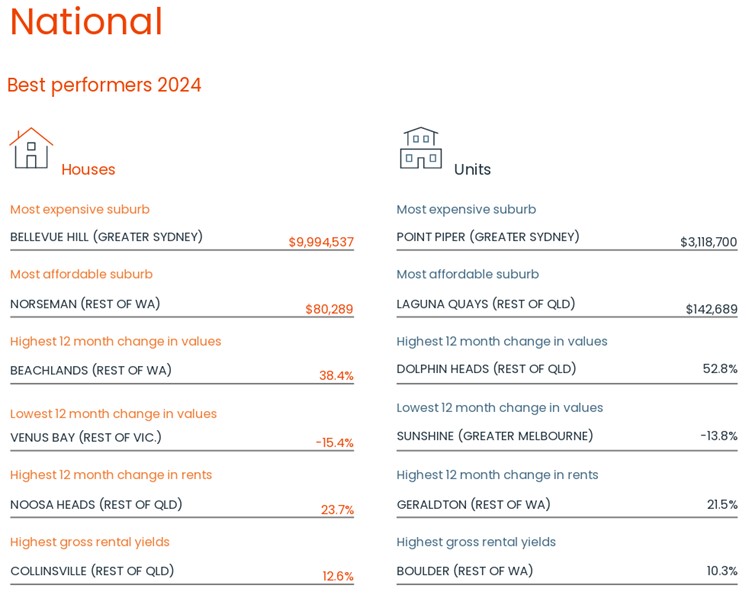

The rise in regional property demand – both from buyers and tenants – helped regional markets outperform capital cities in 2024. CoreLogic’s Best of the Best 2024 report shows that Australia’s regions dominated top-performing house and unit markets.

The only exception? Sydney claimed the title of ‘Most expensive suburb’.

This trend suggests regional homeowners and investors could see solid capital growth if migration patterns continue.

Meanwhile, PropTrack data for December 2024 shows that compared to the combined capital cities – which saw property prices decline by 0.25% during the month – regional prices remained relatively unchanged, rising by 0.03%. Furthermore, home values in the regions outperformed on a year-on-year basis, rising 5.12% compared to 4.59% in the capital cities.

These figures are unsurprising: more people are still relocating from capital cities to regional areas, sustaining demand for housing in these locations. Meanwhile, in many regions, the supply of newly built homes continues to fall short of demand, intensifying competition and pushing up prices for the limited properties available.

That said, regional property markets have not escaped the effects of high interest rates and affordability challenges; they have also shown a slowing trend in value growth, However, CoreLogic analysis for February reveals that the combined regionals index is still recording a stronger monthly growth trend relative to the capitals.

In fact, regional markets seem to be benefitting from a second wind of internal migration, an affordability advantage in certain markets and what looks to be some permanency in hybrid working arrangements across various occupations and industries.

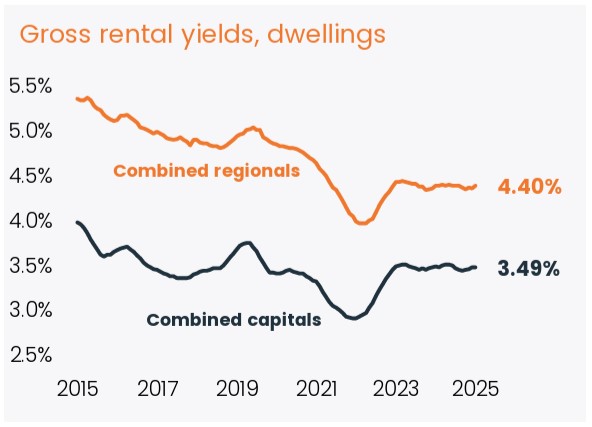

Regional rental conditions have also been stronger than in the capitals, with the combined regional rental index rising 1.6% over the past three months compared with a 0.3% rise in rents across the combined capitals. With both rental growth and value growth easing, gross rental yields have held reasonably firm at around 3.5% for the capitals and 4.4% for regional Australia.