Can property investing buy you time?

Time is a person’s most valuable asset. But often, we spend it occupied by work. Getting stuck in a cycle of working to survive means we don’t have any time left to do the things we enjoy or focus on other ventures. Financial freedom, for many people, means the ability to spend time more fruitfully.

Can property investing get you there? By building a strong real estate portfolio, you can generate passive income, reduce financial stress and, hopefully, build long-term wealth.

Rental income

One of the key benefits of property investment is the ability to earn passive income through rental returns. A well-chosen property in a high-demand location can provide a steady cash flow that covers expenses and puts money into your pocket.

The country’s current rental market is very tight, with low supply and high demand. As a result, rental rates have climbed. CoreLogic research shows that, over the last five years, house rents rose 38.7% and unit rents 35.1% – 5.8 times faster than the change in rents over the previous five-year period. This could translate into steady income for investors.

Capital appreciation and equity

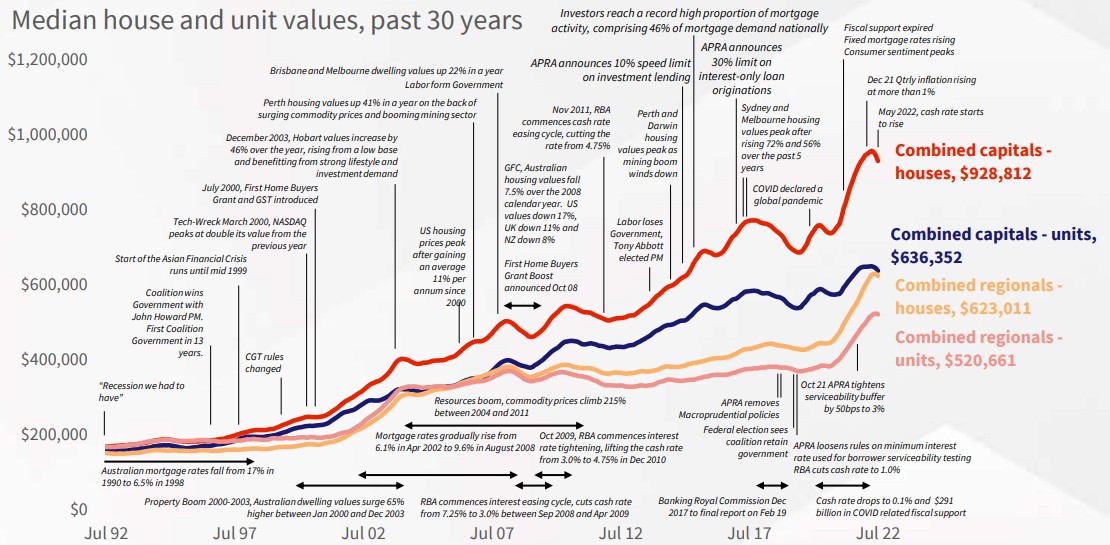

Property values, while cyclical in the short term, have historically grown over the long term. As the graph below shows, research from CoreLogic in 2022 found the overall trajectory of housing values over 30 years was upward, despite periods of decline, such as the global financial crisis and the pandemic.

Since this research, housing values have continued to climb. CoreLogic’s latest data for February shows national dwelling values have risen 38.9% over the last five years.

This growth in value allows investors to accumulate equity. You can then use this equity to buy additional properties, further accelerating your ability to generate a passive income and take advantage of capital growth.

How much time does one spend on property investing?

Since our goal is to buy back time for ourselves, isn’t the process of property investment a time-suck in itself? The answer is that it doesn’t have to be.

First, you can employ the services of an experienced buyer’s agent to help find the right properties. With this person as your trusted guide, you can leave the time-consuming part of finding and buying properties to them – no more viewing properties, conducting due diligence or negotiating with sellers. Your agent can do that for you.

With the right agent, you can rely on their market knowledge and industry connections to find properties that suit your long-term financial goals.

Second, you can employ a property manager to run the rental aspect of your portfolio. This can save you the time of finding and signing tenants and handling their queries. A good property manager can even oversee the maintenance of your property.

Achieving financial freedom

The ultimate goal of property investing is to reach a point where your assets generate enough income to cover your lifestyle expenses. While this is unlikely to happen immediately, through a sound long-term investment strategy and financial discipline, it is possible to buy yourself time.