by Sanjeev Sah | Mar 25, 2023 | Case Studies

This property is located in a high capital growth area in Queensland with a land size of 603 sqm. Standing near the bus stop and schools, this brick house is a 4 bedroom, 2 baths and double garage property. With the purchase price of $350K and rent per week of $430,...

by Sanjeev Sah | Mar 25, 2023 | Case Studies

This property was purchased off the market. It has a land size of 860 sqm and is in a great location. It is a 4-bed, 1 bath and single garage double brick house with a granny flat potential located within close proximity from schools, childcare and...

by Sanjeev Sah | Mar 25, 2023 | Case Studies

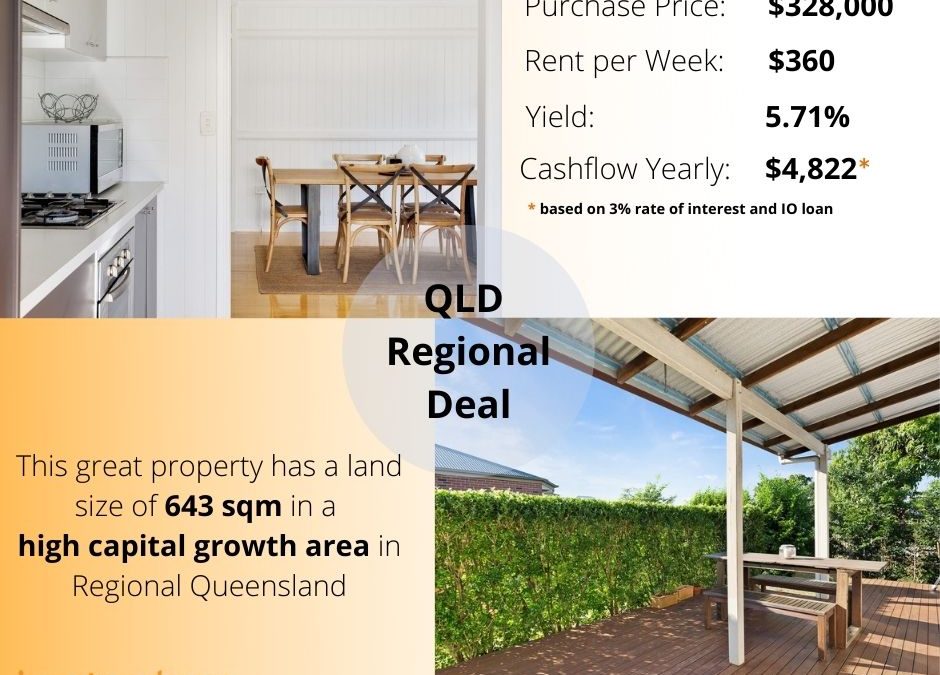

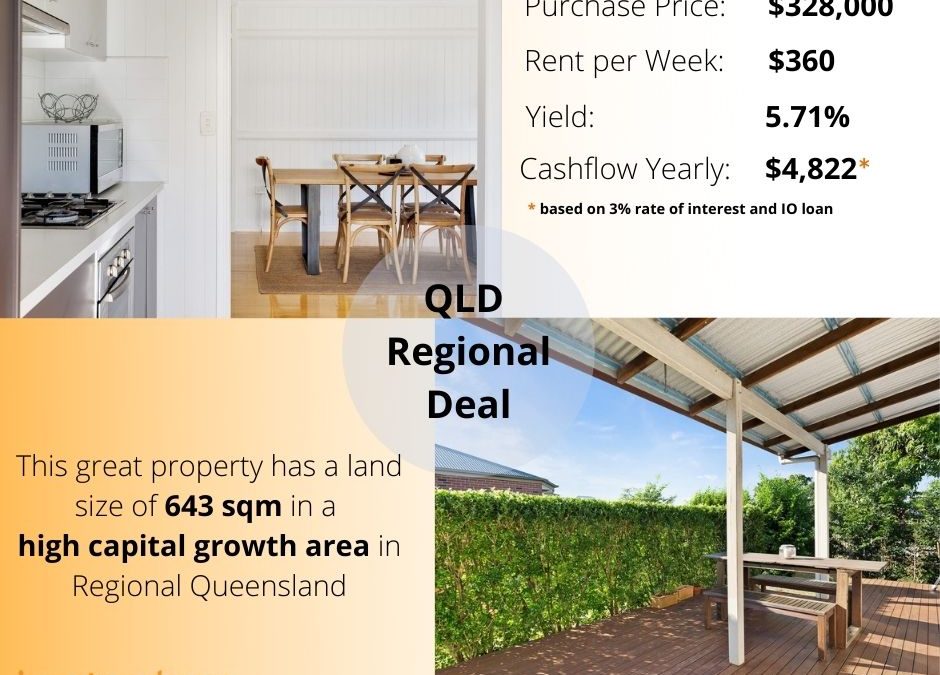

This property has a land size of 643 sqm located in a high capital growth area. It is a 3 bedroom, 1 bath and single garage property. It is in QLD Regional and the property is located near the schools, childcare, shopping centres and transport. With the purchase...

by Sanjeev Sah | Mar 25, 2023 | Case Studies

This amazing colonial-style house is located in the middle of CBD near hospitals, medical centres banks and parks with a land size of 577 sqm. It is a 3-bedroom, 1 bath and single garage property with modern conveniences perfect home to live in. With the purchase...

by Sanjeev Sah | Mar 25, 2023 | Case Studies

This great property was purchased off the market. It has a big land size of 841 sqm. It is a 3-bedroom, 1 bath and double garage property located in a high capital growth area which also has the potential to build a granny flat. With the purchase price of $410K and...