BLOG

Regional vs city property: What the data says

Regional vs city property: What the data says Recent data shows regional property markets are continuing to record solid price growth and strong rental yields, often beating their capital city counterparts. For investors, this might raise the question: should you buy...

Rents reaccelerate as low supply tightens the market

Rents reaccelerate as low supply tightens the market Australia’s rental market has gained momentum again, with conditions tightening as available rental properties remain limited. According to Cotality’s Quarterly Rental Review, national rents rose 1.3% in the...

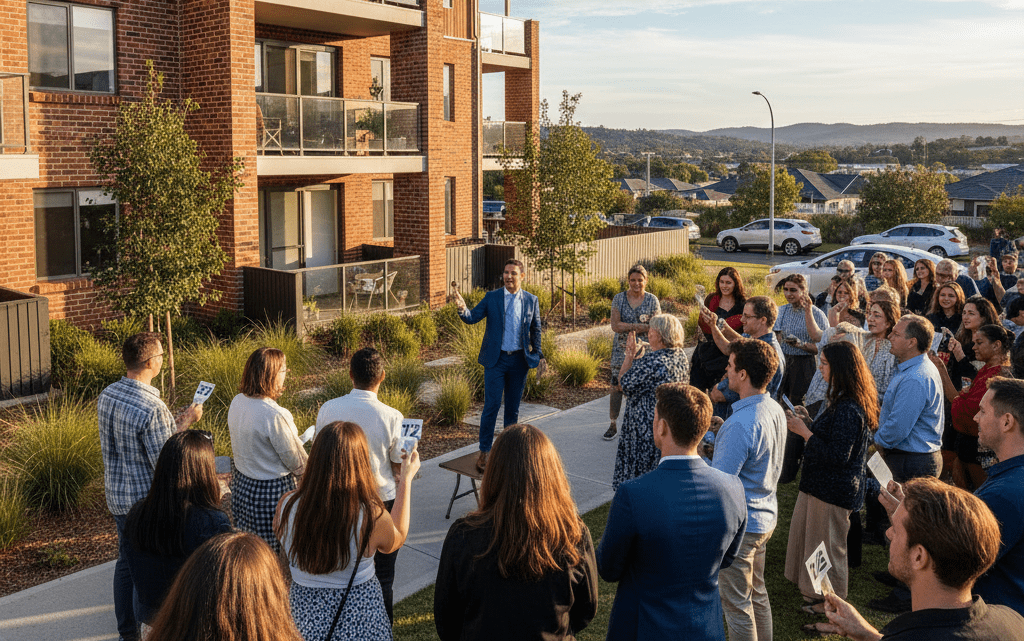

First home buyers vs returning investors: who’s driving property prices?

First home buyers vs returning investors: who’s driving property prices? Australia’s housing market is heating up again, with both first home buyers and returning investors competing for limited stock. The Reserve Bank of Australia (RBA) has warned that a surge in...

What investors need to know ahead of a busy spring selling season

What investors need to know ahead of a busy spring selling season Australia’s property market is picking up speed just in time for spring. Cotality’s latest Home Value Index shows national dwelling values rose 0.7% in August, the strongest monthly gain since May...

How a buyer’s agent can help investors stay competitive as demand rises

How a buyer’s agent can help investors stay competitive as demand rises Spring is shaping up to be one of the most competitive buying seasons in recent years, with the latest cash rate cut expected to intensify demand. According to REA Group analysis, lower...

Australia’s real estate rally – why now could be the time to act

Australia’s real estate rally – why now could be the time to act Momentum is building in the property market, with nearly every major city showing strength. Ray White reports that all major markets are now in a coordinated acceleration phase, with house and unit...

How lower interest rates are influencing property prices

How lower interest rates are influencing property prices The Reserve Bank of Australia’s (RBA) May rate cut is already flowing through the property market. It was the second cut this year, with the cash rate lowered by 25 basis points to 3.85% amid soft GDP growth and...

What Labor’s re-election means for property investors in 2025

What Labor’s re-election means for property investors in 2025 With the Labor government back in office, its housing agenda is gathering momentum. While much of the focus has been on helping first home buyers – from 100,000 new builds to the expanded Home Guarantee...

Trump’s tariffs: What investors need to know

Trump’s tariffs: What investors need to know US president Donald Trump’s tariffs have caused widespread uncertainty and nervousness in the global economy. With so much still unclear, it's important for property investors to stay informed. Trump has proposed a...

Can property investing buy you time?

Can property investing buy you time? Time is a person’s most valuable asset. But often, we spend it occupied by work. Getting stuck in a cycle of working to survive means we don’t have any time left to do the things we enjoy or focus on other ventures. Financial...