Market Updates

Market Update-11-Mar-25

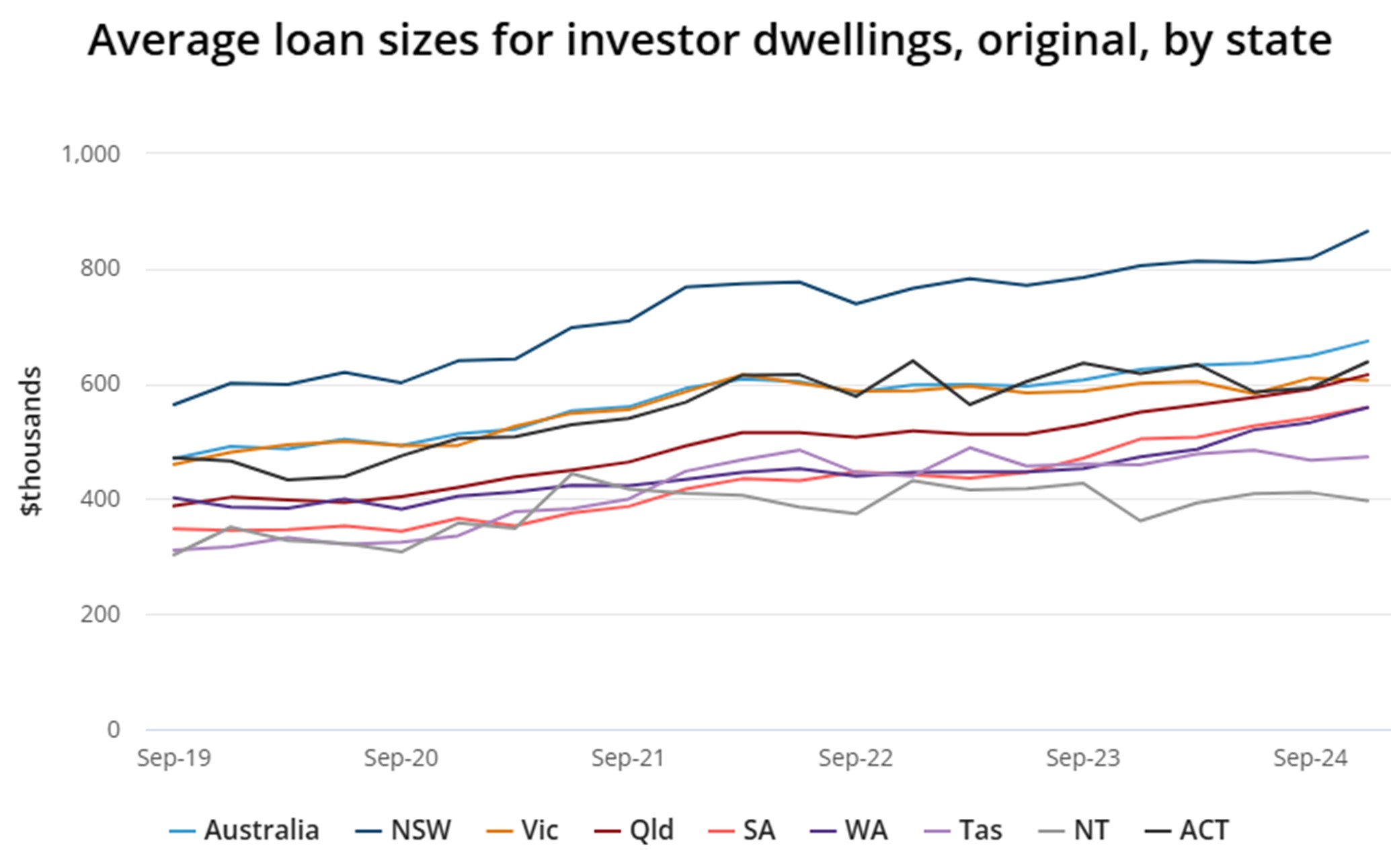

The number and total value of new investment loans approved in the December 2024 quarter fell 4.5% and 2.9% respectively compared to the previous three-month period, according to the Australian Bureau of Statistics…

by Sanjeev Sah | Mar 11, 2025 | Market Updates

Market Update-04-Mar-25

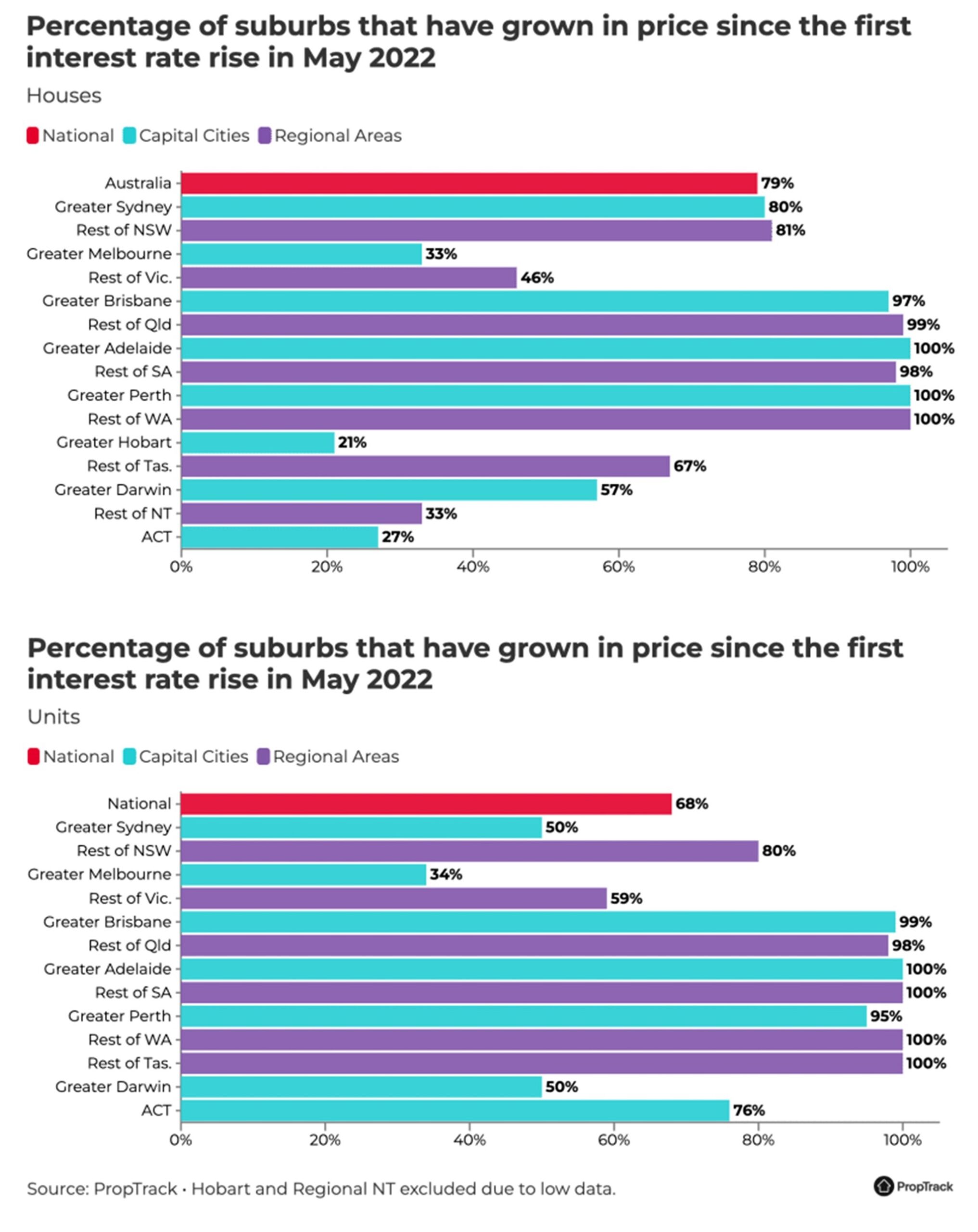

High interest rates typically mean lower property prices, but home values in most suburbs across Australia have defied this trend, according to PropTrack.…

by Sanjeev Sah | Mar 04, 2025 | Market Updates

Market Update-25-Feb-25

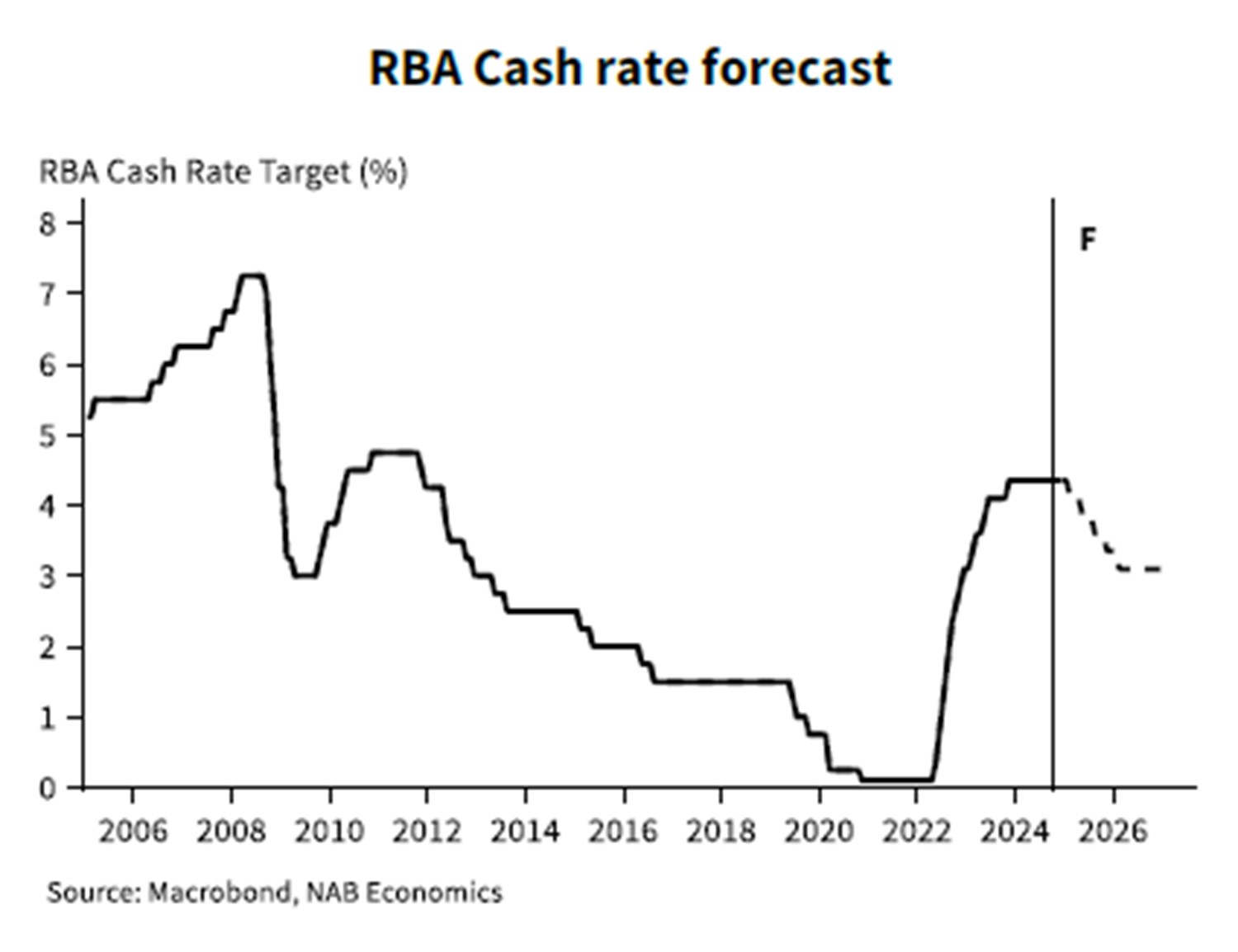

NAB is the last of the big four banks to bring forward its cash rate cut forecast to February but maintains that the rate reduction cycle will be one of gradual easing…

by Sanjeev Sah | Feb 25, 2025 | Market Updates

Market Update-18-Feb-25

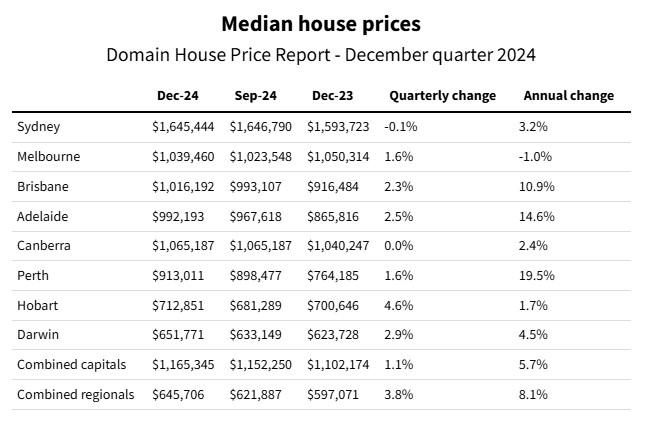

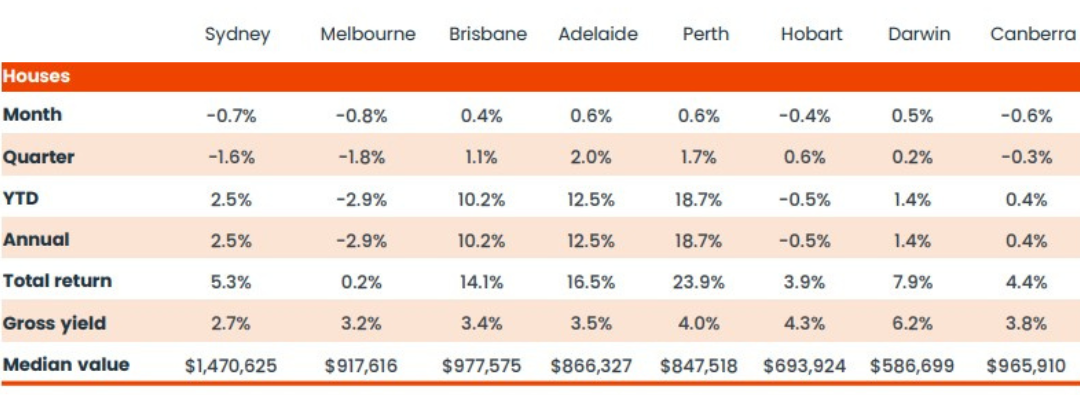

Five out of Australia’s eight capital cities will have a median house price of more than $1 million within a matter of weeks despite a national slowdown in the market, according to Domain…

by Sanjeev Sah | Feb 18, 2025 | Market Updates

Market Update-11-Feb-25

Property investors should factor in the possibility of an interest rate cut in the near future, as it could significantly influence the housing market in 2025. With inflation now within the Reserve Bank of Australia’s target range, both the Commonwealth Bank and ANZ believe the cash rate is likely to be cut in February…

by Sanjeev Sah | Feb 11, 2025 | Market Updates

Market Update-04-Feb-25

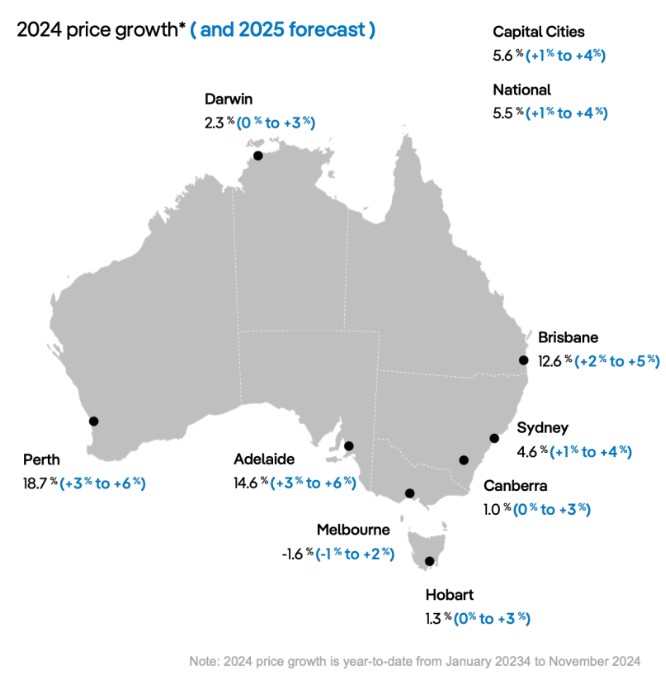

Property prices are expected to continue climbing in 2025, but at a slower pace than 2024, according to PropTrack’s Property Market Outlook. The report predicts growth of between 1 and 4% this year, down from the 5.5% seen in 2024…

by Sanjeev Sah | Feb 04, 2025 | Market Updates

Market Update-28-Jan-25

As an investor, one of the key metrics you should look at when buying an investment property is your total return. This is the annual capital growth plus the rental yield. The good news is that, according to CoreLogic, the total return for houses in all capital cities was positive in December 2024…

by Sanjeev Sah | Jan 28, 2025 | Market Updates

Market Update-21-Jan-25

Imagine you could jump in a time machine and go back to 2005. Would you buy an investment property? “Of course,” you’d probably reply. “Prices were much, much lower, so I know I’d enjoy incredible capital growth…

by Sanjeev Sah | Jan 21, 2025 | Market Updates

Market Update-14-Jan-25

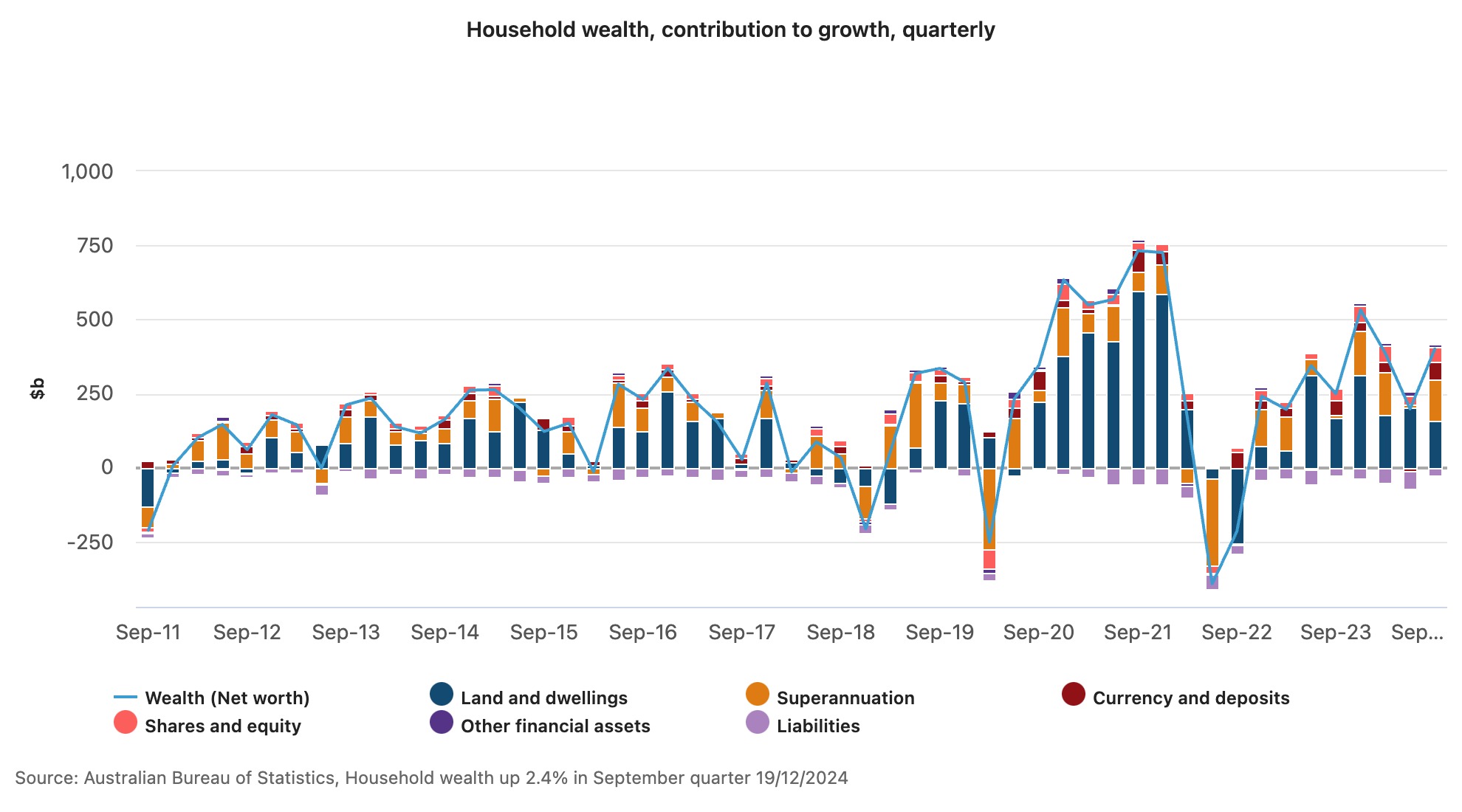

Household wealth surged by 2.4% in the September 2024 quarter, reaching a record $16.9 trillion, according to the Australian Bureau of Statistics (ABS). That’s a staggering $401 billion increase in just three months, and means household wealth is up 9.9% year-on-year…

by Sanjeev Sah | Jan 14, 2025 | Market Updates

Market Update-07-Jan-25

Investors looking for good rental yields have many options in the current market, according to CoreLogic. Over the past year, the national rental yield has remained stable at 3.7%. But, the picture is more nuanced across different cities…

by Sanjeev Sah | Jan 07, 2025 | Market Updates