OUR RECENT PURCHASES

Case Study 21

This property is in the center of regional NSW. It has a land size of 735 sqm that has the potential to build a granny flat which can increase the value and cashflow of the property.

With the purchase price of $333,000 and $320 rent per week, this property clearly shows positive cashflow and the potential of manufactured equity.

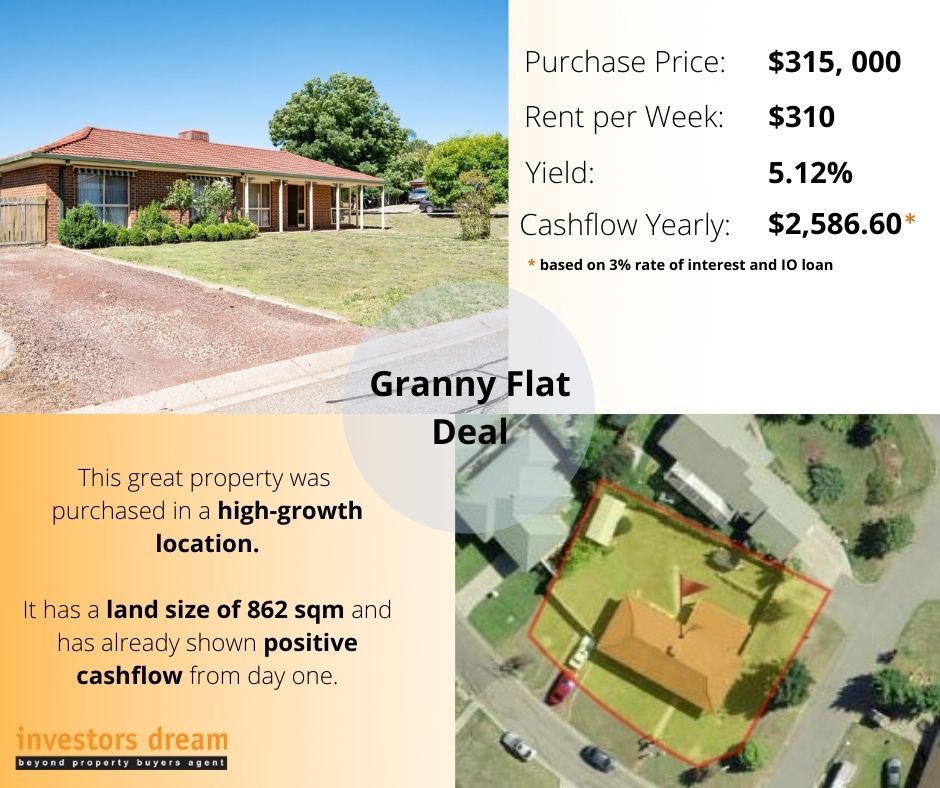

Case Study 20

This property has been settled in March 2021. It is in the center of the regional CBD near the Plaza, schools and childcare facilities.

It has a land size of 862 sqm and has the potential to build a granny flat which can increase the value and cashflow of the property.

With the purchase price of $315,000 and $310 rent per week, this property clearly shows positive cashflow from the day it was purchased.

Case Study 19

This property located in a high capital growth area and was purchased off the market. It has a land size of 836 sqm that has the potential to build a granny flat or another dwelling which can increase the value and cashflow of the property.

With the purchase price of $300,000 and $330 rent per week, this property clearly shows positive cashflow and starts earning from day one.

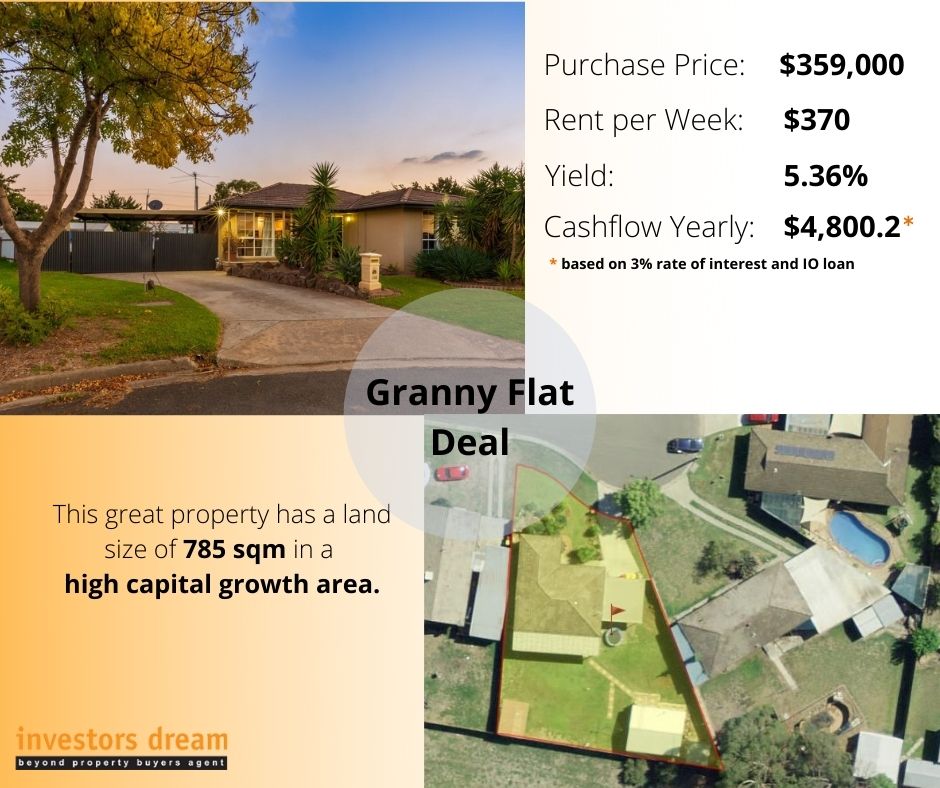

Case Study 18

This property was purchased by a sophisticated investor as their 4th property. It is in the center of regional NSW. It has a land size of 785 sqm that has the potential to build a granny flat which can increase the value and cashflow of the property.

This property is located in a high capital growth area near schools and childcare.

With the purchase price of $359,000 and $370 rent per week, this property clearly shows positive cashflow and the potential of manufactured equity.

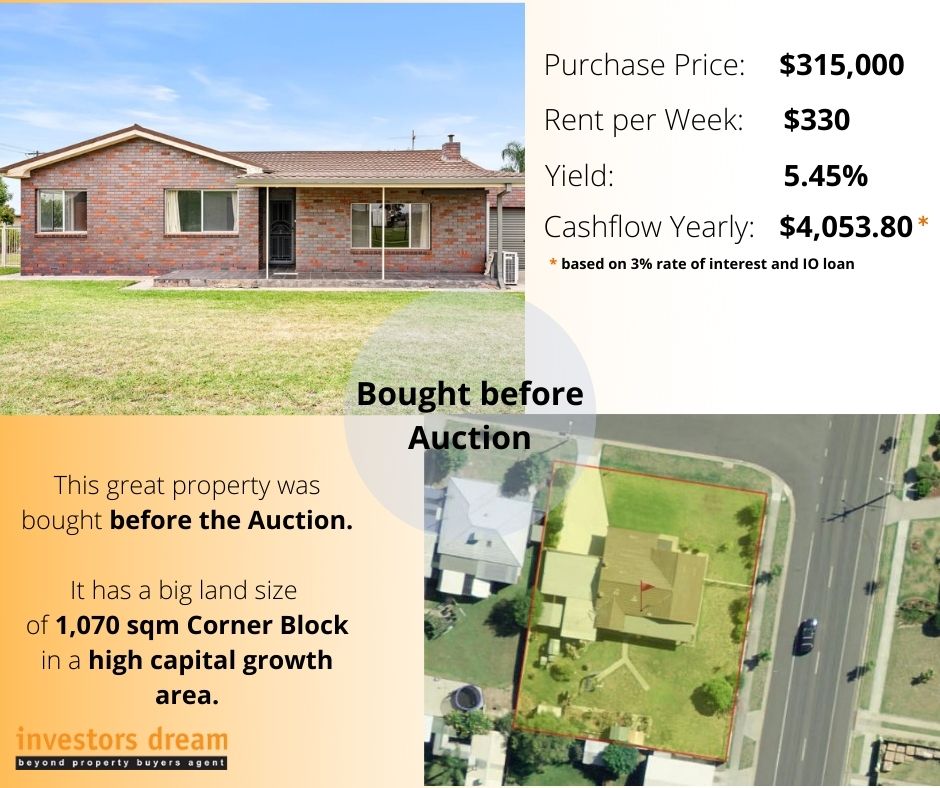

Case Study 17

This property was bought before auction located in the center of regional NSW in a high capital growth area. It is a corner block and has a big land size of 1,070 sqm that has the potential to build a granny flat or another dwelling which can increase the value and cashflow of the property.

With the purchase price of $315,000 and $330 rent per week, this property clearly shows positive cashflow and the potential of manufactured equity.

Case Study 16

This property has two units in one block that was bought before the Auction. It has a land size of 999 sqm located in the centre of the town.

With the purchase price of $415,000 and $600 rent per week, this property clearly shows positive cashflow of $1,100 a month and the potential of manufactured equity.

Case Study 15

This property was purchased off the market in the center of regional NSW. It is located near the schools, daycare, medical and shopping centres.

It has a land size of 696 sqm that has the potential to build a granny flat which can increase the value and cashflow of the property.

With the purchase price of $350,000 and $370 rent per week, this property clearly shows positive cashflow and the potential of manufactured equity.

Case Study 14

This property has a land size of 739 sqm that has the potential to build a granny flat which can increase the value and cashflow of the property. It is in the center of regional NSW.

With the purchase price of $370,000 and $370 rent per week, this property clearly shows positive cashflow and can help you finance your next investment property.

Case Study 13

This property was settled in March 2020 with a decent land size of 574 sqm. It is in a high capital growth area near Brisbane CBD.

In just a year, this property has a capital growth of 10% already.

With the purchase price of $348,000 and $330 rent per week, this property clearly shows positive cashflow and the potential of manufactured equity.

Case Study 12

This property is in the center of regional NSW. It has a land size of 772 sqm that has the potential to build a granny flat which can increase the value and cashflow of the property.

With the purchase price of $372,000 and $420 rent per week, this property clearly shows positive cashflow and the potential of manufactured equity.