OUR RECENT PURCHASES

Case Study 11

This great property has been settled in April 2020 and within a year, it has a capital growth of 19%.

This property is closer to Brisbane CBD. It has a land size of 640 sqm near parks, shopping centres and local schools.

With the purchase price of $370,000 and $370 rent per week, this property clearly shows positive cashflow from day one.

Case Study 10

This property has been bought off the market which is in the center of the town near schools. It has a land size of 717 sqm which has the potential to build a granny flat that can increase the value and cashflow of the property.

With the purchase price of $350,000 and $370 rent per week, this property clearly shows positive cashflow and the potential of manufactured equity.

Case Study 9

Case Study 8

This property was settled in September 2019 as an owner-occupied property located near Schools, train stations and shopping centres. It has got more than 10% of capital growth for 18 months.

This property has four bedrooms, two bathrooms and a double garage with a land size of 540 sqm.

It is located in a high capital growth area in Melbourne and suited the requirements of the client such as within the budget and convenient location.

This amazing property was purchased at $590,000 and if it will be converted into an investment property, it could be a positive cashflow from day one and ideal for converting into roaming house too.

Case Study 7

This property was purchased before the Auction with a decent land size of 639 sqm. It is in a high capital growth area near to shops, transport, schools and parks.

It is a three-bedroom property with a single carport and garden shed.

With the purchase price of $230,000 and $270 rent per week, this property also has the potential to build a granny flat which clearly shows positive cashflow and the potential of manufactured equity.

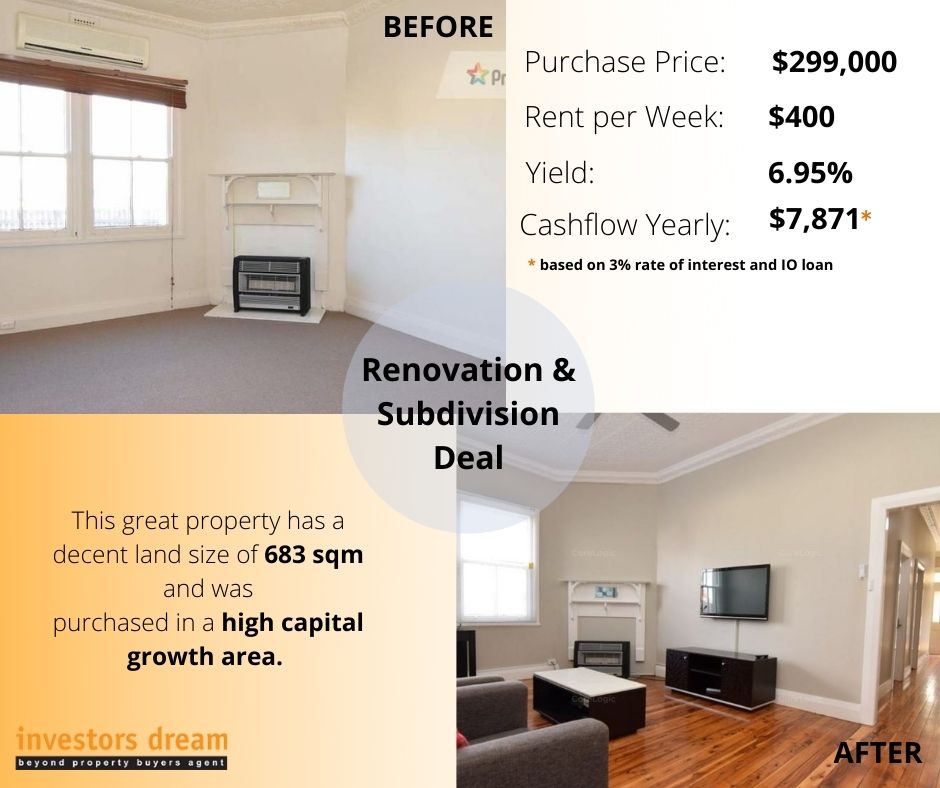

Case Study 6

It is a four-bedroom house located in a high capital growth area with a decent land size of 683 sqm. It was purchased at $299,000 with $400 rent per week which shows positive cashflow.

Immediately after the renovation, the property value increased to $410K and now it’s worth $480K and has also got 3 bedrooms, 2 baths and single garage, subdivision and build approval.

Case Study 5

This property was purchased within half an hour from Adelaide City with a decent land size of 676 sqm. It is in a high capital growth area close to schools, shops, sports facilities, parks and public transport.

It is a four-bedroom property with a single bath and double garage.

With the purchase price of $398,000 and $400 rent per week, this property clearly shows positive cashflow from day one.

Case Study 4

This property was settled in October 2019 and after a year and five months, it has got a capital growth of 10%. It was purchased for a client who is an experienced investor.

It has a decent land size of 500 sqm located in the centre of the town near shops, stations and cafes. It had renovation potential plus land has commercial zoning.

With the purchase price of $340,000 and $360 rent per week, this property shows positive cashflow. The property value increased by $80k immediately after the renovation which shows the power of manufactured equity.

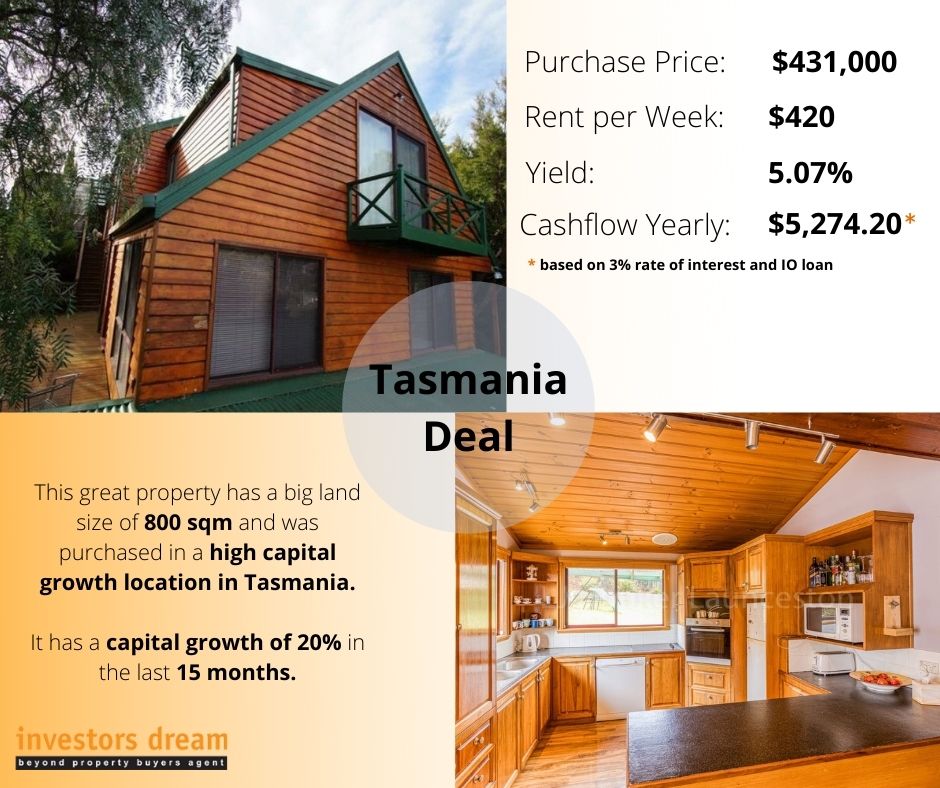

Case Study 3

This property was settled in March 2020 for an experienced investor as their 4th property and has a capital growth of 20% after a year and three months. It has four bedrooms, two baths and double carports located in Tasmania. It has a big land size of 800 sqm offering a generous size of home with two levels of floor plan.

With the purchase price was $431,000 and $420 rent per week, this property clearly shows positive cashflow from day one.

It is located near the general hospital, public transport and schools which also added to the increase of more than $80K in property value after a year.

Case Study 2

With the purchase price of $296,000 and $420 rent per week, this property clearly shows positive cashflow. Immediately after the renovation, the property value got $400k and in a year time, the property value is $450k.

It is a four-bedroom property located in the centre of Regional CBD near to Sydney in a high capital growth area which also has the potential to build a granny flat. It was purchased for a first-time investor aiming for positive cashflow and did a renovation for instant equity.